|

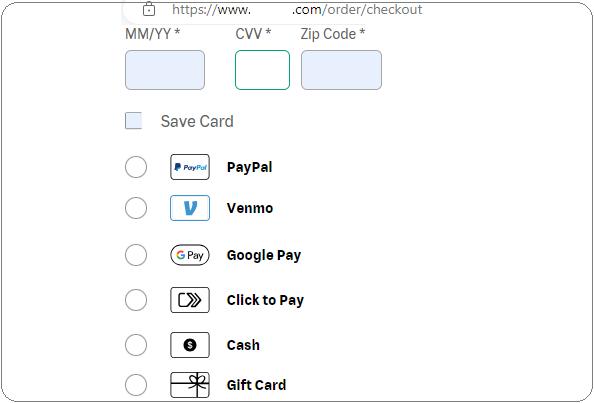

| Credit card (top) and several digital payment alternatives accepted for online pizza order 1/2024 |

In the mood for pizza, I noticed the neighborhood kiosk gave $8.99 as the carry-out price for a large pizza with 1-item added. Out of curiosity before telephoning my order, I tried the online order website and discovered the same pizza in the Specials tab for $7.99 so I went through the ordering process there. After selecting crust (original), sauce (original), toppings (normal vs. extra; whole spread vs. half covered in A and the other half in B), it was time to review the order and proceed to the form of payment (above screenshot).

There are probably many more services to broker digital payment based on smartphone app than the ones above, but this franchise pizza shop has chosen all of these in addition to credit (and debit) cards. These days a few establishments boldly state at the entrance they accept no cash: all transactions must take some form of electronic payment. Probably "no cash" also implies no personal checks, either, since the burden of proceeds being paid in check or cash means that the owner must travel to a bank for deposit, or to pay an armored car to make that trip safely. As one small business owner put it, "all forms of payment have a fee or cost," if not a percentage given up to the app or 3rd party, then the value of one's time and the risk of banking in person. So whether it is the 2 to 4% that the business loses to financial service companies who mediate the transaction, or it is the value of one's own time for record-keeping, taxes, and travels to the bank for petty cash and for deposits, there is always part of the transaction with customers that retailers lose.

Back in the 1950s a few oil companies would issue cards of credit to customers buying gas at a branded, company gas station. Later some department stores issued cards in their name. After that the big banks began to offer their biggest or best customers a line of revolving credit on the monthly billing cycle, a sort of perpetual short-term loan one month after another. As more and more consumers gained discretionary income and mail order (catalog and telephone) shopping expanded, more and more people applied for bank cards; some carried more than one card. Once the battle for sign-ups among banks took off in the 1980s, bigger and bigger incentives to apply emerged. Consumers could cancel one card and initiate another one to roll over balances due and also to collect the incentives available for airline mileage credits, cash-back, sign-up bonus, and so on.

By the late 1980s or early 1990s a new product was invented for telecommunication orders, particularly attractive to people with difficulty meeting credit card requirements. This was the advent of debit cards in which the purchase electronically debited one's checking account almost instantly. There would be no monthly statement with balance due because the payment would have been directly taken from the account holder's funds at point of sale. The old-school credit card in its many guises (from bank, airline, hotel chain, restaurant, catalog merchant, etc) and the newer debit card dominated the field of electronic payment and recordkeeping until the spread of smartphones and apps with a family resemblance to credit cards.

The first smartphones began to appear in retail stores and online in USA around 2005, but only a fraction of people carried any kind of cellphone for daily personal use, and few could see the appeal or value of a smartphone costing many times more than the older cellphones. But with innovation cycles accelerating, more and more people became used to seeing others on TV or in real life talking on cellphones and keeping one charged up and its subscription paid up. Among cellphone users, more and more bought a smartphone. The idea of misplacing one's phone and potentially exposing to strangers (or hackers) any financial details or personal information kept smartphone users from whole-heartedly depositing sums in a digital wallet, much as app designers and retailers wanted the purchasing pace to speed up.

During the first years of Covid-19, from spring 2020 into spring 2023, so much of work, school, and personal life was mediated by online meetings and transactions that the presence and convenience of digital money began to enter some of the smartphone users' minds. But for those growing up with coins and paper notes, legal tender backed by "the full faith and credit of the United States of America," the ease of payment was simultaneously the ease of being hacked or cleverly talked into losing control of those funds by various forms of scam, phishing, or fake communications that spoof the name of a trusted friend or family member.

So this screenshot of the handful of contenders for digital payment is an ongoing experiment to see which brand will attract most users, biggest dollar aggregated sales, common use by retailers and the frequent app support they depend on. Maybe 12 months from now the field will narrow, or some of those visible above will disappear through merger and acquisition and a different contender will be in the line-up. Expanding the financial service providers over and over soon leads to "paralysis by analysis" (too much information to think about; too many choices). Maybe a year from now a backlash will see cash return and digital payment disappear. By contrast, urban South Korea and many parts of the People's Republic of China are thriving with digital wallets; doubtless with growing pains, scams, and identity theft, etc, but yet something they press onward to some natural conclusion.

A related transformation in financial matters is the cryptocurrencies like Bitcoin. Some national treasuries (PRC, Central Bank digital currency, USA "FedNow" epayments) are exploring the idea of limited (special context) use digital national currency for paying taxes and issuing monthly social security checks or for health insurance matters (Medicaid, Medicare), as an example. Whether it is consumer transactions face to face and from a distance, or it is financial affairs between citizen and central government, the landscape of payment and storing wealth is slowly changing.

No comments:

Post a Comment